SINGAPOREAN INVESTORS 🇸🇬

Our Story - from 0 to 40+ properties in less than 5 years

We handle everything for you, from finding good deals, managing refurbishments to finding tenants - you just watch your portfolio grow, providing monthly cashflow and steady capital growth.

Watch this short video to see how it works:

See some of the fantastic investment properties we have acquired:

meet the founder - Edward crowe

My journey from 0 to 40+ properties in less than 5 years...

Before launching Dragon Investments, I spent 18 years in finance across London, Paris, and Singapore.

In the last 4 years, I built a 40+ property portfolio worth millions while working full-time in Singapore - so I know exactly what works for overseas investors.

Worked in investment banking for 18 years

40+ properties acquired in 4 years

Built my portfolio while living in Singapore

Built a property team in South Wales, UK

where i started

Working in finance in Singapore

Before launching Dragon Investments, I spent 18 years in finance across London, Paris, and Singapore.

I was working 50+ hour weeks, generating a good income, but I knew I needed to invest.

I knew that the UK property market was great, but it felt impossible - living thousands of miles away on the other side of the world.

investment number 1 - 2022

It all Started With One Property Investment

This was the property that started it all. I leveraged a team of reliable builders, estate agents and finance brokers in the UK to make this investment possible.

now - 2026

I Used Systems To Add 40+ Properties to My Investment Portfolio

Fast forward to now, my investment portfolio is worth more than £6,000,000 and generates a rental income of more than £40,000 every single month.

The number one thing that allowed me to scale so quickly was my investment system. I have managed to build this huge portfolio, without stepping foot in the UK myself.

My Investment Strategy - The BRRR Method

The BRRR Method is a popular property investment strategy used commonly in the UK to grow a portfolio quickly while recycling the same pot of money. It is one of the most trusted and reliable ways to build a portfolio safely.

I used this strategy to add properties to my portfolio while recycling the same pot of cash over and over again.

Buy

Purchase a property below market value, often because it’s run-down, inherited, or needs work.

Investors usually use cash, a bridging loan, or a mortgage to buy it.

Refurbish

Renovate the property to increase its value and rental appeal. This could include adding a new kitchen/bathroom,

painting, flooring, plastering, fixing structural or cosmetic issues.

This refurbishment boosts the property’s market value.

Rent

Once the property is completed, it’s rented out to tenants.

This step provides a monthly income (cash flow) and keeps the property viewed as an income-generating asset, which helps with refinancing.

Refinance

We now ask the bank to revalue the property and refinance it based on its new, higher value.

From this refinance, you withdraw your initial investment (deposit + refurb costs).

In an ideal BRRR deal you get all or most of your money back and still keep the property, tenants, and rental income.

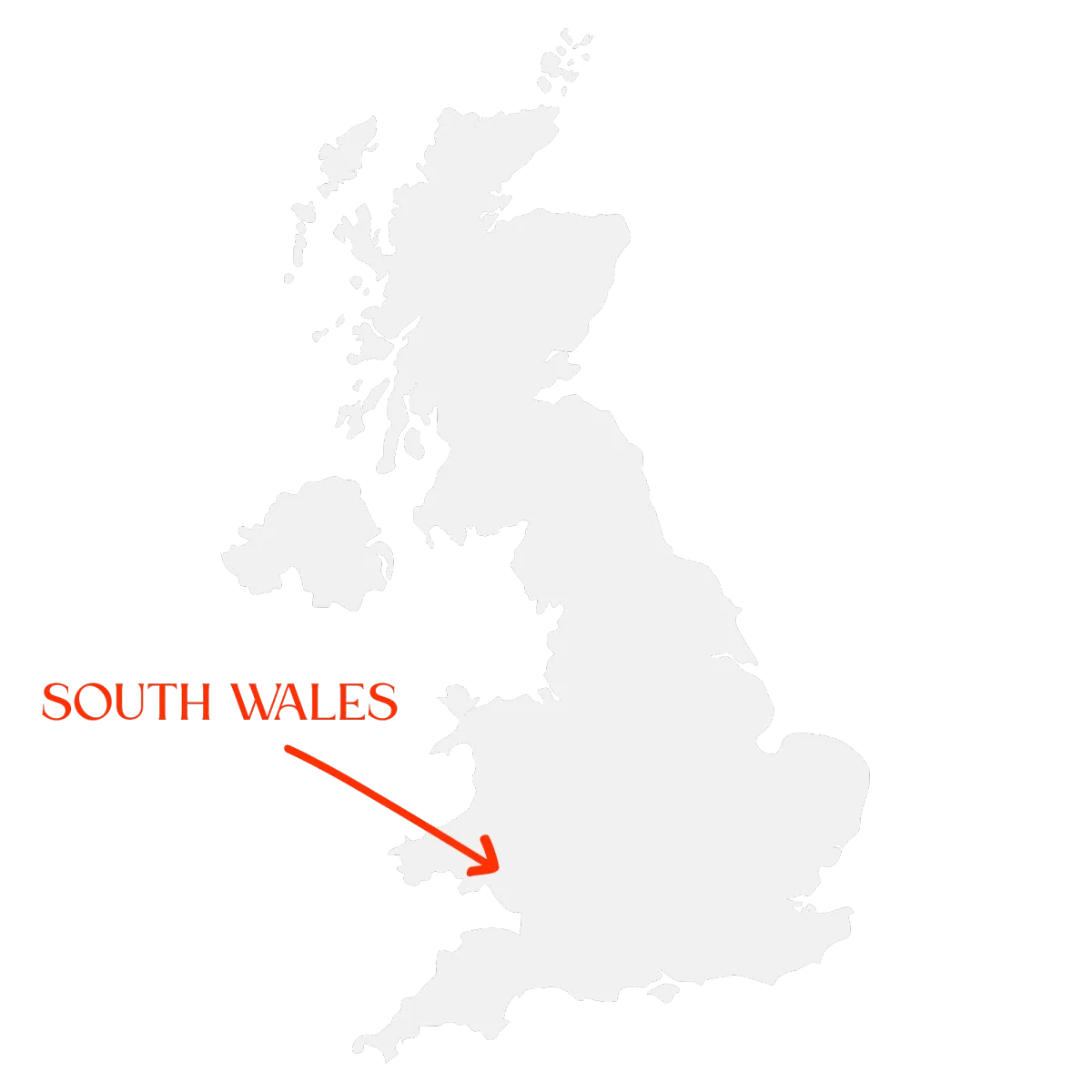

My Investment Area - South Wales, UK

South Wales is one of the most affordable regions in the UK. You can still buy 3-bed houses for £70,000–£90,000, with rental yields of 8–10% and forecasted 27% price growth between 2026–2030.

I was born and raised in South Wales and have built strong local connections in the property industry.

Huge Rental Demand

South Wales attracts a lot of rental demand with big cities like Newport & Cardiff. It also has a direct train to London.

Low House Prices

You can purchase properties in South Wales for as low as £70,000 and add value with refurbishment. Much lower than London or Southern England.

High Yield/ROI

Rental yields of 8-10% are common in South Wales. Property price growth is also forecasted 27% in the next few years.

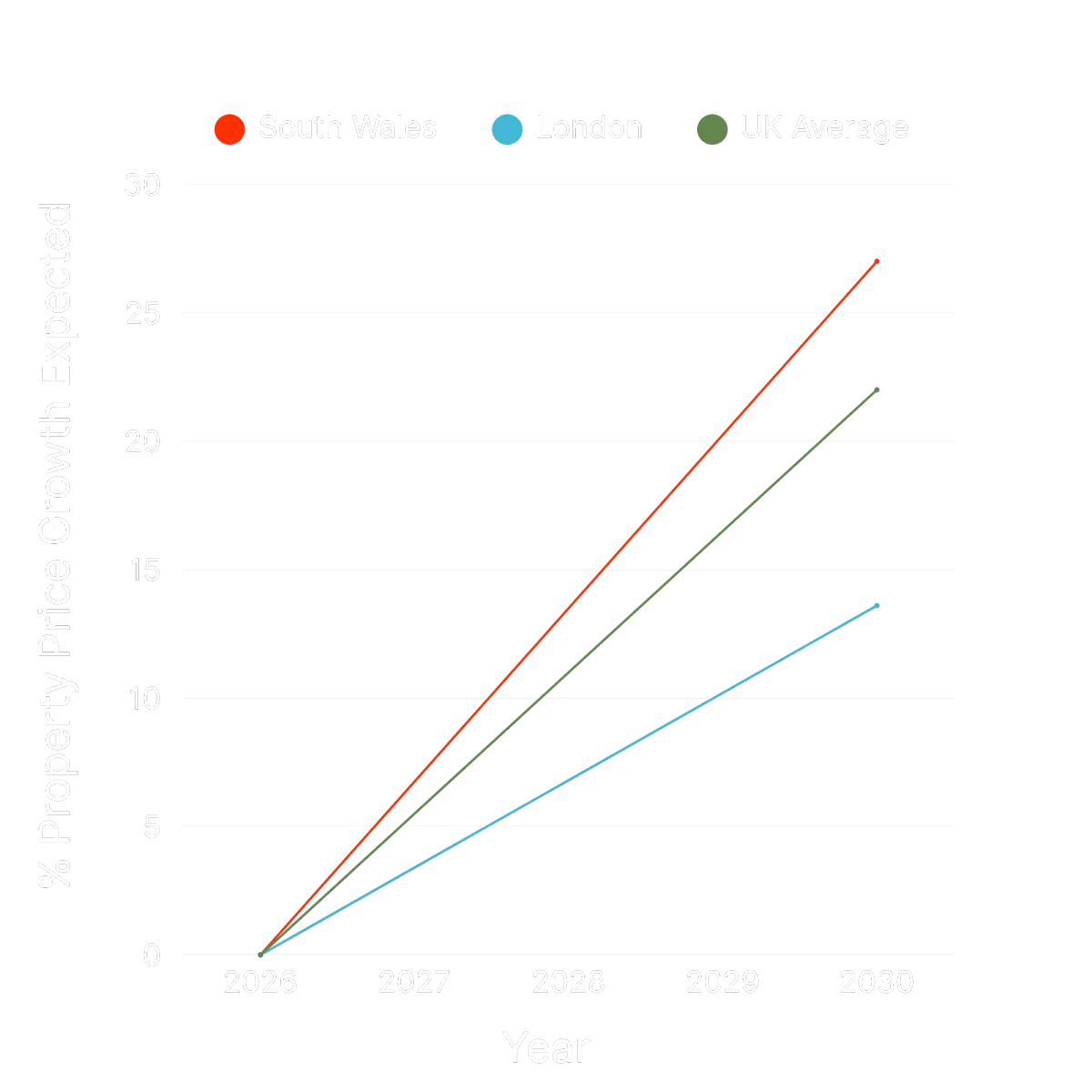

South Wales vs London

Recent studies show that house prices are expected to increase by 27.6% over the next 5 years in South Wales. The UK average is just 22% and London is extremely low at 13%.

free guide

Learn exactly how I managed to grow my property portfolio from Singapore.

Discover the exact region, strategy, and process used by international investor Edward Crowe to generate safe, predictable returns in the UK - completely hands-free.

Building my portfolio changed my life...

From 2007 to 2025, I worked in finance roles across London, Paris and Singapore.

In 2022, while based in Singapore, I began investing in UK property to build passive income and a reliable asset base. Managing everything remotely, I built a portfolio of 40+ properties and left my finance career.

Before

Working 50+ hour weeks

Climbing the corporate ladder

Investing in low return products

No control over my financial life

Now

Working on my own terms

Spending days with my family

Appreciating portfolio with high returns

Total financial freedom

Some of my latest property deals:

Trying to grow your own property portfolio is impossible while working full time.

I built a team in the UK that does it all for me:

Sourcing

I have built a reliable network in South Wales that allows me to access the best property deals.

Refurbishment

We have a refurbishment team on the ground in the UK to handle everything.

Management

We use trusted lettings and estate agents to manage our properties.

Ready to Build Your UK Property Portfolio - Without Leaving Singapore?

You’ve seen the results we've achieved. Now it’s your turn to start.

A personal investment strategy session

Property sourcing, negotiation, and due diligence

Full refurbishment management

Overseas mortgage/finance support

Lettings coordination

Monthly progress reports and mentorship from me

I created the Portfolio Builder Programme - a done-for-you investment service where we build your UK property portfolio, end-to-end.

This isn’t a sales pitch - it’s a genuine strategy session to see if Dragon Property Investments is the right fit for you.

Book your free portfolio consultation with Edward and discover how to safely build a hands-off UK property portfolio that grows in value every month.

STILL NOT SURE if it's right for you?

Frequently Asked Questions

We know investing abroad can feel daunting - here are the answers to the questions every Singaporean investor asks before they start.

How much capital do I need to start?

Most clients begin with £50,000–£80,000, which comfortably covers the purchase, renovation, and refinance of their first UK property. Once refinanced, much of this capital can be recycled for the next deal. The more capital you have, the faster you can grow your portfolio.

Do I need to travel to the UK?

No. The entire process - from sourcing to letting - is handled for you. You’ll receive regular photo and video updates from our UK team during renovations and handovers.

Can I get a mortgage as a Singapore resident?

Yes. We partner with mortgage brokers who specialise in expat and overseas investor lending. Many of our clients buy with 70–75% LTV mortgages.

How long does the first project take?

Typically 3–6 months from initial consultation to completed refurbishment and tenant move-in. Timelines depend on market conditions and project size.

What returns can I expect?

Our clients typically achieve 8–10% gross rental yields and 30–80% ROCE (Return on Capital Employed) depending on project scope and refinance valuation.

Is my money safe?

Absolutely. All transactions go directly through solicitors and regulated financial channels. You’ll hold legal ownership of the property from day one.

How do you choose investment locations?

We focus on South Wales, one of the UK’s highest-yielding regions. Edward and his team have refined a proven model for sourcing and managing houses that deliver strong returns and capital growth.

What makes Dragon different from other UK sourcers?

Unlike most sourcers, we focus solely on Singaporean investors and offer a full-stack service - sourcing, refurbishment, refinance, and letting - guided by Edward, who’s personally built a 42-property portfolio from Singapore.

Can you manage multiple properties for me?

Yes. Many clients build portfolios of 5–10 properties over time. Once the first property is successfully refinanced, we use released capital to fund the next purchase.